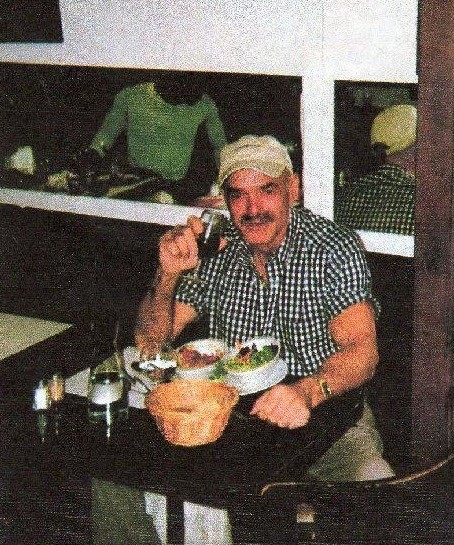

You'll love the photo on the next page from former state legislator out of Dana Point Diane Harkey, who is currently the 4th District member of the California Board of Equalization, a.k.a. the state tax board. The photo shows a group of senior citizens smiling to go along with an article posted on Harkey's BOE page, “Senior Citizens Day: Recognizing Our Most Golden Citizens.” Not smiling among them is golden citizen Kurt Sipolski, who a judge long ago ruled is owed six figures from Harkey's estranged husband Dan. Sipolski, who lives mostly off Social Security in Palm Desert, is now selling his furniture on craigslist to survive.

]

After USA Today wrote about Sipolski's plight that began when he and other mostly retirees invested in Harkey's Point Center Financial mortgage finance business years ago, Harkey sued Sipolski for $50 million last August. The case was dismissed as frivolous, which is ironic because as an assemblywoman and state senator, Diane Harkey had campaigned that frivolous lawsuits are part of what's killing America. Double ironically, she would file her own frivolous lawsuit against an opponent for her BOE seat because he dared bring up the elder financial abuse case against her then-un-estranged husband.

For the suit against Sipolski, Dan Harkey was asked to pay the $30,000 legal fees, something that has not been done, according to the former defendant, who says he's also heard Harkey is being fined $1,000 a day for refusing to file the correct paperwork in his bankruptcy-related cases. Sipolski wonders how Harkey's attorneys are getting paid.

In addition to fighting to keep his home even though the justice system says he is owed plenty from Dan Harkey, Sipolski has been writing. A former reporter for Rupert Murdoch's Daily Mirror group in Sydney, Australia, Sipolski has been published in The Desert Sun, Palm Springs Life magazine, the Los Angeles Times, the International Herald Tribune and San Francisco Gentry magazine, which he founded and published.

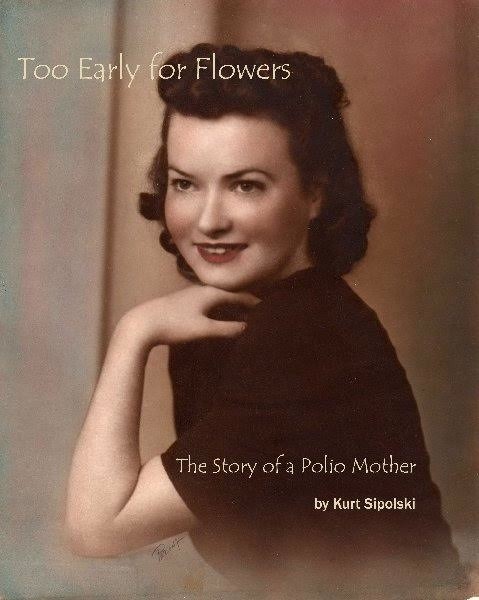

His novella Too Early for Flowers: The Story of a Polio Mother, is based on his own mother Iris raising two boys, including a child with polio, Sipolski himself. Find it on Amazon.

As you might imagine, Sipolski has also been writing about his nightmare with Dan Harkey, even after others in the investment pool hoping to get something, anything back through the court process have told the author he has been getting too much publicity.

For the Weekly, Sipolski wrote what follows on the next page …

[

BANKRUPTCY BREAKING POINT

By Kurt SipolskiMany of the statements made by Donald Trump in the recent debate made an impression on me.

The most profound was, when asked if he felt bad that so many of his investors lost everything when he declared bankruptcy, he replied, “Well, they weren't nice people.”

He said he merely took advantage of the American way of protecting business: declaring bankruptcy.

The implication being, as long as business survives, it does not matter what happens to investors.

This affected me because I am a creditor in a bankruptcy, and in fact, have lost my life savings.

Several years ago I invested in a trust deed company, Point Center Financial, valued at $500,000,000. Owned by Dan Harkey, he said he had been in business for many years, and was married to the then-Assemblywoman Diane Harkey, (now a member of the State Board of Equalization.) They lived in a multi-million dollar estate in Dana Point overlooking the Pacific.

I figured my six-figure investment was safe since the loans were backed up by bricks and mortar and personal guarantees of the borrowers.

Ever since I was a little boy in braces from polio, my parents taught me a strong work ethic, to spend cautiously and to save and invest judiciously. My jobs had been interesting but paid nothing substantial: a reporter in Sydney for Rupert Murdoch's chain, an airline clerk with Qantas, a magazine publisher in San Francisco. My savings were hard-earned.

About the time the (man-made) financial crisis occurred, Harkey announced he was no longer paying dividends, and all refunds were put on hold.

I phoned him, suggesting that he lower the interest payments substantially and work with the borrowers.

He said no, that he may have to sell all properties at a 90 percent loss.

One can only imagine if all properties in California lost 90 percent of their value overnight. All was lost, however.

Needless to say, many of us sued and won for Elder Financial Abuse and were awarded $12,000,000 and he was found guilty of “malice, oppression or fraud.”

It was not all the money we had invested, but enough to live on (we ARE seniors.)

But Harkey had declared bankruptcy, saying he had assets of only about $100,000,000.

The verdict and award were two years ago. All plaintiffs are older. Most have health issues. Some have died. Not one cent has been paid. Collection efforts to find any money to pay us have been futile.

Harkey is now operating a similar company, Cal Comm, and sending out notices to realtors.

Although I am a modestly successful author, my main income is from Social Security. My loss of income shows. My dishwasher is broken. Two burners on my stove are broken. My window screens are in tatters.

I ask, “What is the breaking point, and why are regulations stacked against the investors in favor of businesses?”

Are laws made by the rich for the rich?

Email: mc****@oc******.com. Twitter: @MatthewTCoker. Follow OC Weekly on Twitter @ocweekly or on Facebook!

OC Weekly Editor-in-Chief Matt Coker has been engaging, enraging and entertaining readers of newspapers, magazines and websites for decades. He spent the first 13 years of his career in journalism at daily newspapers before “graduating” to OC Weekly in 1995 as the alternative newsweekly’s first calendar editor.