If the death of a $184 million bailout ultimately kills the developer of homes above the ecologically sensitive Bolsa Chica wetlands, preservationists may have karma, an ancient Indian curse or an Orange County Register investor to thank.

Or all three.

]

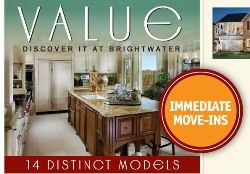

Register real estate reporter Marilyn Kalfus blogs that California Coastal Communities, developer of the Huntington Beach Brightwater/Hearthside Homes projects, informed the Securities and Exchange Commission (SEC) that a previously announced $184 million financing deal that would pull the company out of Chapter 11 bankruptcy has fallen through.

The financing, which included interest rates ranging up to

15 percent, was approved by regulators in June but it expired Aug. 31.

The plan was intended to refinance $181.5 million in Brightwater debt incurred by California Coastal, which still plans to usher in dozens of new homes on the mesa where it has already built hundreds.

Land that is ecologically sensitive and sacred among local American Indians, it must be noted.

The lender was supposed to be New York-based Luxor Capital Group, LP, which is one of three investment firms with ownership stakes in Irvine-based Freedom Communications,

the Register's parent company that knows a thing or three about emerging from bankruptcy.

Ironically, as California Coastal debt started mounting years ago as its

projects won approvals, a stockholder had urged the company to put

itself up for sale. California Coastal officials refused, deciding to

soldier on with building.

Then the housing market crashed.

California Coastal's $182 million in debt as of filing for Chapter 11 in

October had grown to $204 million by the end of 2009, Kalfus notes.

Speaking of itself, California Coastal told the SEC, “The Registrant continues to have discussions with its

stakeholders regarding a consensual restructuring; however, there can be

no assurance that such a consensual restructuring can be achieved.”

What a shame.

OC Weekly Editor-in-Chief Matt Coker has been engaging, enraging and entertaining readers of newspapers, magazines and websites for decades. He spent the first 13 years of his career in journalism at daily newspapers before “graduating” to OC Weekly in 1995 as the alternative newsweekly’s first calendar editor.