The head of an Irvine loan modification company formerly known as Hope to Homeowners–allegedly to mislead victims into believing it was part of the same-named program launched by the Bush Administration in 2008 to aid struggling families with mortgage payments by refinancing their existing home loans–was arraigned Thursday on 165 felony grand theft counts.

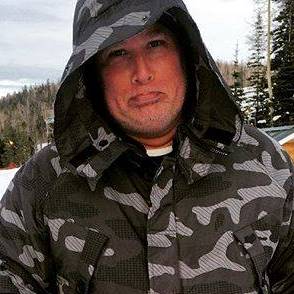

Kahram Zamani, 37, of Laguna Hills, is accused of defrauding and victimizing 165 distressed homeowners out of $177,000 by fraudulently promising to save their homes in exchange for an up-front fee, according to an Orange County District Attorney's office statement that follows after the jump . . .

]

January 28, 2010

LOAN MODIFICATION COMPANY PRESIDENT ARRAIGNED ON CHARGES OF DEFRAUDING 165 DISTRESSED HOMEOWNERS

SANTA ANA – The president of an Irvine loan modification company was arraigned today for defrauding and victimizing 165 distressed homeowners out of $177,000 by fraudulently promising to save their homes in exchange for an up-front fee. Kahram Zamani, 37, Laguna Hills, is charged with 165 felony counts of grand theft with sentencing enhancements for aggravated white collar crime for taking more than $100,000. If convicted, Zamani faces a maximum sentence of 113 years in state prison. The defendant is out of custody on $100,000 bond and is scheduled for a pre-trial hearing March 18, 2010, at 8:30 a.m. in Department C-55, Central Justice Center, Santa Ana.

Between February 2008 and December 2009, Zamani, a licensed real estate broker, is accused of owning and running Infinity Group Services (Infinity), a loan modification company that targeted distraught homeowners. The company was formerly known as Hope to Homeowners, named to mislead victims into believing it was part of the 2008 program launched by the Bush Administration, “Hope to Homeowners,” which aided struggling families with mortgage payments by refinancing their existing home loan.

Zamani is accused of soliciting clients through radio ads. He is accused instructing his employees to make promises to consumers, knowing the promises were false, that the company could obtain a home loan modification or loan forgiveness in exchange for an up-front fee of $995. The defendant is accused of also instructing his employees to make false promises that they could secure low-interest rates on a modified mortgage loan, offer full refunds if a loan could not be modified, and stating that Infinity had a 98 percent success rate in obtaining loan modifications.

After the consumer paid the up-front fee, they were rarely able to contact the Infinity employee handling their case. When the consumer made contact with the Infinity sales representative handling their case, the Infinity employees are accused of giving misleading information about the progress of their modification request, charging an additional fee in order to secure the promised interest rate, and telling homeowners that the new rate would not be honored without payment of the additional fee.

This case has been a collaborative effort between the Orange County District Attorney's Office (OCDA), California Department of Real Estate (CDRE), and Federal Trade Commission (FTC). In August 2009, the FTC filed a civil complaint in federal court seeking a temporary restraining order, the freezing of assets, and a preliminary injunction. In November 2009, CDRE filed a formal accusation charging the defendant with violations of real estate law, and today filed an order against Zamani to desist and refrain from further fraudulent practices.

The investigation is ongoing. Anyone with additional information or who believes they have been a victim is encouraged to contact Supervising District Attorney Investigator Ron Frazier at (714) 347-8691. Victims may also download a complaint form from the OCDA's website at www.orangecountyda.com.

Deputy District Attorney George McFetridge of the White Collar Crime Team is prosecuting this case.

OC Weekly Editor-in-Chief Matt Coker has been engaging, enraging and entertaining readers of newspapers, magazines and websites for decades. He spent the first 13 years of his career in journalism at daily newspapers before “graduating” to OC Weekly in 1995 as the alternative newsweekly’s first calendar editor.