What's that neighbor of yours up to, I mean really? Can we ever know? Well, in the case of the following 32 Orange County neighbors, we now know they've been up to stealing and embezzling and frauding buttloads and buttloads of moolah.

]

Pursuing the American Dream … of Ponzi Schemes and Real Estate Fraud!?!

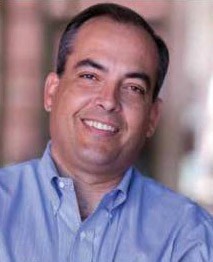

1) Christopher Lee Diener

The 46-year-old attorney, who lived in Ladera Ranch and had offices in Irvine, has a new address for the next two years: jail. That's because he ripped off a credit card company for more than $200,000. He's also lost his law license and was arrested in January 2010 in connection with home loan modification fraud where he and two business partners were accused of victimizing more than 400 homeowners. That case was dismissed after a preliminary hearing, but they still face allegations of fraud in a civil suit filed by the Attorney General against their business, Home Relief Services LLC.

2) Stephen Lyster Siringoringo

The State Bar of California last month suspended the license of Garden Grove attorney Stephen Lyster Siringoringo for illegally taking fees in advance to help distressed homeowners modify their loans and allowing non-attorneys to meet with clients and perform legal services for them without supervision. Both practices violate state law. The bar had been looking at an 18-month suspension of Siringoringo's law license for collecting fees upfront from 20 clients, prompting Siringoringo to refund fees that ranged from $1,500 to $5,970 to 14 clients. But then the state bar received 796 additional complaints from clients.

3-6) The Shah Family

Four members of a family worked in the home-loan business–and secured loans for “straw buyers” using forged and false documents before pocketing $16 million in proceeds. The last to be sentenced recently–to seven years in state prison–was 65-year-old Dinesh Valjeebhai Shah, who also must pay $12,800 in restitution and previously earned two years in the can for failing to report his ill-gotten gains on his tax returns. Suniti Shah, 53, got eight years in state prison, Supriti Soni, 54, picked up 10 years and Soni and Suniti Shah's mother, Sushama Devi Lohia, 76, of Newport Beach, was sentenced to eight years. The Shahs owned and operated New Age Realty, First Property Escrow, City First Realty, and Associates Investments Group–all from the same Tustin address. Soni owned and operated Vason Development in Santa Ana, which processed home loan applications. Licensed real estate agent Lohia worked out of both offices.

[

7-10) OC Real Estate Flippers

A South Orange County mother who became an anti-drug activist after her son died of an overdose is among four people convicted in federal court in Santa Ana for a real estate flipping scheme. Sylvia Melkonian is scheduled to be sentenced in March for her part in the scam that had investors thinking they would profit off properties that were to be acquired and resold within a year when in reality they were nearly impossible to sell or did not even exist. Craig Shults, 43, of Huntington Beach was sentenced to 90 months in federal prison and ordered to pay $2 million in restitution, but he says he plans to appeal his conviction. Paul Licausi was ordered to pay $1.4 million in restitution and is scheduled to report to federal prison Feb. 6 to begin his three-year term. Fellow Floridan Joseph Haymore, 32, was sentenced to 57 months in federal prison and also ordered to pay $1.4 million in restitution.

11-16) OC Credit Repair Fraudsters

Six Orange Countians have been sentenced in federal court recently for their parts in a nationwide, $15 million mortgage fraud scheme that promised to help homeowners avoid foreclosure and repair their credit. The leaders were brothers Charles Head of Pittsburgh, PA (and formerly Los Angeles) and Jeremy Michael Head of Huntington Beach. They were sentenced to 35 years and 10 years in prison respectively. Other locals sentenced were: Leonard Bernot of Laguna Hills (18 months in prison); Andrew Vu of Santa Ana (six months in prison followed by six months of home detention); Lisa Vang of Westminster (three years probation); and Irvine's Justin Wiley and Elham Asasdi (18 months in prison and six months of home detention respectively). Six others around the country (but mostly Southern California) have received sentences ranging from probation to prison time in the case. Four others have yet to learn their fates.

17) Priscilla Villabroza

A Placentia nurse already serving a 4 1/2-year prison term for defrauding Medi-Cal is facing new federal charges stemming from her operation of a hospice that submitted millions of dollars in allegedly fraudulent bills to Medicare and Medi-Cal. Priscilla Villabroza, 68, and her 43-year-old daughter Sharon Patrow are each charged in federal court in Santa Ana with 25 health care fraud and money laundering counts, each one of which carries a potential multiple-year prison sentence, according to the U.S. Attorney's Office. The mother and daughter operated California Hospice of Covina. Among four other Southern Californians charged in the alleged scam that's said to have billed the government $9 million for services not rendered is Dr. Sri Wijegoonaratna, a 60-year-old Anaheim Hills physician who worked at the hospice and allegedly recruited patients.

[

18-19) Huntington Beach Elementary School Embezzlers

Ricardo Nieva, the former finance director of the Pegasus School, has copped to two counts of wire fraud in the federal government's case that alleged the 49-year-old Trabuco Canyon resident embezzled more than $2 million from the private Huntington Beach elementary school to pay for Angels season tickets, vacations to Europe and other personal expenses. Nieva, who was the school's business manager for nearly 20 years, would spend less than 3 1/2 years in prison under a plea deal that also calls for him to pay restitution. As we've previously reported, Gail Diane Monestere has admitted to embezzling more than $22,000 while she was president of the Parent Teacher Organization at Sun View Elementary School, a public school in Huntington Beach. She has been in out and of jail while trying to pay back the money and avoid a prison stretch.

20-21) James Eberhart and Eugene M. Carriere

Also as previously reported here, James Eberhart has admitted to orchestrating a scheme that used an online ad by an unwitting Tom Bosley–the late actor who played Howard Cunningham on Happy Days–to scam hundreds of investors out of $13 million in the 1990s. Eberhart managed to elude federal prosecution from November 1999 through May 2012, when he was arrested in Malaysia. He pleaded guilty in September to two counts of mail fraud, and U.S. District Judge Cormac Carney recently sentenced him to 10 years in prison and ordered him to pay $12,838,045 to more than 800 victims across the country. Eberhart's former partner-turned-co-defendant Eugene M. Carriere, who eluded authorities for six years before he was arrested in Thailand in 2005, previously got three years in federal prison and a $12.8 million restitution order.

22-25) Filling Station Fraudsters

Donald Keith Goff pleaded guilty in July to mail, wire and bank fraud charges in federal court and the Laguna Niguel 67-year-old was recently sentenced to 6 1/2 years behind bars. Already indicted by a federal grand jury for separate fraud allegations, Goff ran a series of schemes to defraud banks and the Small Business Administration out of $4.5 million through a loan he obtained to buy a Fountain Valley gas station. Goff received help from his wife and stepdaughter in the original frauds, and after being indicted for those he got his criminal defense attorney to help with a new fraud. Federal Judge Andrew Guilford ordered Goff to pay $1.6 million in restitution–so far, explaining that total may rise in the future. Next up, Guilford will sentence Goff's wife, stepdaughter and the attorney, Gino Pietro, who have all pleaded guilty to felonies. That caused Pietro to have his law license suspended by the state bar in June.

[

26-30) OC Ponzi Scammers

Lambert Vandertuig pleaded guilty to more than 80 felonies and acknowledged multiple sentencing enhancements in a plea bargain he struck recently with the state Attorney General's Office that earned the 56-year-old 20 years in prison for orchestrating a Ponzi scheme. Claiming legendary golfer Arnold Palmer was a partner in their Irvine-based Carolina Development, Vandertuig and his employees sold $52 million worth of stock that they pledged to spend on acquiring and developing luxury resorts. Some land was acquired and left undeveloped, while about $24 million was spent on personal medical bills, airplanes, posh meals, expensive cars, concert tickets and luxurious vacations. Some victims were senior citizens who'd invested their retirement funds, and when complaints rolled in, early investors were paid back with funds from newer investors. Mark Sostak, is scheduled to be sentenced Feb. 20 in Santa Ana after copping to two felony counts of making a false statement or omission in connection with a purchase or sale in the case. Robert Waldman, 54, cut a plea deal and is expected to be sentenced to six months of home confinement. Jonathan Carman, 51, and Scott Yard, 53, pleaded guilty

recently to multiple felonies; Carman could get 12 years in prison at his Feb. 20 sentencing, while Yard is expected to get six years on March 9. The only remaining defendant, Soren Svendsen, 49, is scheduled to be tried this month.

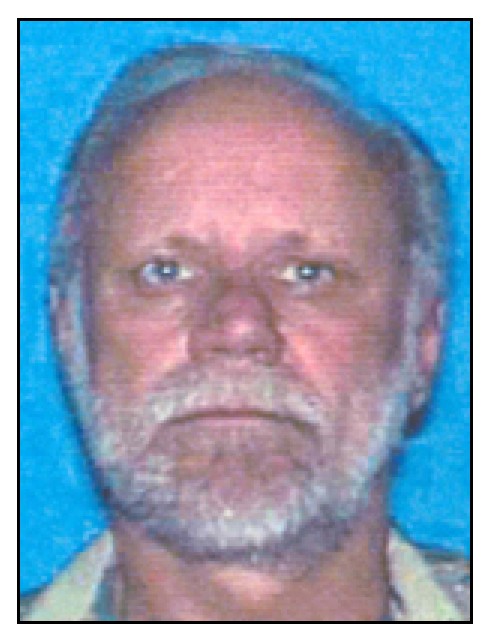

31) Robert Barth

A 62-year-old Laguna Niguel financial planner was recently sentenced to more than nine years and four months in prison after being found guilty of defrauding victims of nearly $500,000 from their retirement accounts. Robert Barth was a certified financial planner and acted as a financial advisor to the victims, including one who considered Barth his

best friend and others who knew him through their children and grandchildren's school. Barth persuaded investors to roll their retirement funds into self-directed IRAs without knowing that he took control of the funds and transferred them into his personal accounts. Victims learned they'd been had several years later when they were informed there were no mortgage notes and their entire IRA investments were lost.

32) Michael Schwartz

Federal Judge David O. Carter in Santa Ana sentenced Michael Schwartz Monday to 37 months in federal prison and ordered him to pay $1.8 million in restitution for burning investors in and lenders to his mortgage company, Service First. Schwartz took money from investors to make hard loans and secure them with real property–or at least that's what he told them. instead, he paid off other investors or used the funds for personal expenses, such as rents, dining and shopping. Patch's Paige Austin reports: “Schwartz is best known in San Juan Capistrano for his role as manager of the SJC Sports Rink, where he turned a dilapidated building leased from the city into an indoor rink and home to the local roller hockey team, the SJC Nightmare. He made headlines for his efforts to turn the facility into a thriving sports arena that would house indoor hockey and lacrosse teams.” The city gave Schwartz 30 days to vacate the premises this summer after he pleaded guilty.

Email: mc****@oc******.com. Twitter: @MatthewTCoker. Follow OC Weekly on Twitter @ocweekly or on Facebook!

OC Weekly Editor-in-Chief Matt Coker has been engaging, enraging and entertaining readers of newspapers, magazines and websites for decades. He spent the first 13 years of his career in journalism at daily newspapers before “graduating” to OC Weekly in 1995 as the alternative newsweekly’s first calendar editor.