The hits keep coming for embattled Securities and Exchange Commission Chairman Christopher Cox, the former local congressman (R-Newport Beach). Amid the Bernard L. Madoff scandal, Cox last week publicly blamed his staff for not vigorously investigating complaints against the fraudster. Today, we hear from…

Wayne State State Law School professor Peter J. Henning, in the New York Times: “I always thought the whole idea of leadership was that 'the buck stops

here,' which means the chairman takes the blame when something goes

awry and does not blame his underlings. Instead, what we have is a

lesson in how not to run an agency charged with protecting investors.”

agency will ripple through the economy long after he's gone.”

Miami Herald editorial: “Apparently, it took

a gigantic swindle like the pyramid scheme allegedly run by Bernard

Madoff to get SEC Chairman Christopher Cox to admit that the Securities

and Exchange Commission has fallen down on the job. Trouble is, Mr. Cox

himself has been instrumental in turning Wall Street's watchdog into a

meek lapdog.”

Toldeo Blade editorial: “Mr. Cox's furious finger-pointing at lower-level

SEC employees he claims failed to detect Mr. Madoff's humongous Ponzi

scheme is validation of what we wrote in this space in June, 2005, when

Mr. Cox, a former Republican congressman from California, was appointed

to his job by President Bush.

“To reprise, we averred that Mr. Cox 'could very well prove to be

another in a series of determined predators sent forth from the great

white den at 1600 Pennsylvania Avenue to keep a hungry eye on Wall

Street coops.'”

Youngstown Vindicator (Ohio) editorial: “The best thing that can be said about the Securities and Exchange

Commission under the leadership of Chairman Christopher Cox is that the

agency responsible for protecting U.S. investors will soon be under new

management.”

Yeeee-ouch!

]

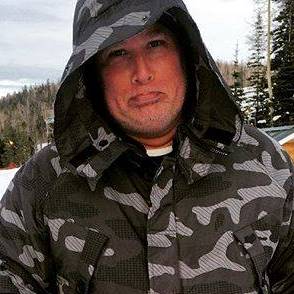

But the photo illustration here comes from the March/April 2007 edition of The American magazine, which argued 1 1/2 years into Cox's tenure that the Bush appointee was defying lowered expectations.

Cox has taken a methodical, consensus-driven approach to the SEC's

work, seeking to forge unanimous 5-0 voting blocs within the

commission. Last summer, 12 months into the Cox regime, AFL-CIO

associate counsel Damon Silvers told Dow Jones News Service: “While he

hasn't done everything I would do, he's done pretty well.” David

Yermack, a finance professor at New York University's Stern School of

Business, says, “I really had low expectations for Cox,” but he's been

“a pleasant surprise…. He's really embraced the shareholder reform

agenda.” Now, Yermack thinks that Cox–whom he once deemed “a Republican

tool of business”–should be considered for Treasury secretary.

Book that Yermack character on the next train to Crazy Town.

OC Weekly Editor-in-Chief Matt Coker has been engaging, enraging and entertaining readers of newspapers, magazines and websites for decades. He spent the first 13 years of his career in journalism at daily newspapers before “graduating” to OC Weekly in 1995 as the alternative newsweekly’s first calendar editor.